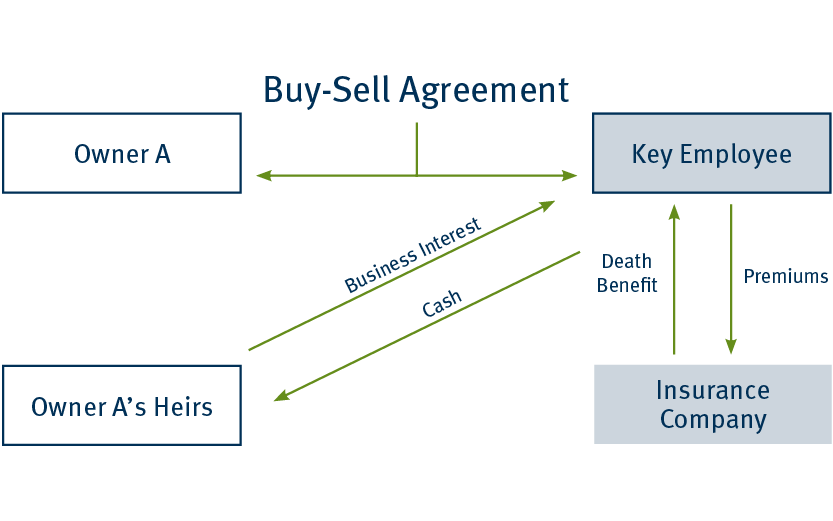

Unilateral Buy-Sell Arrangements

A buy-sell agreement identifies a buyer for a business in the event of an owner’s death. In a unilateral arrangement, a third party (typically a key person and/or family member working in the business) is obligated to purchase the interest of the departing owner. To fund the buyout, the third-party purchases a life insurance policy on the life of the owner. Upon the death of the owner, the third party receives the life insurance proceeds and purchases the deceased owner’s business interest from his or her estate. The third party owns the business, and the non-liquid business interest is converted to cash for the heirs.

Client Profile

- Business with one owner

Why It Is Used

- Guarantees a market for future sale of the business

- Allows a non-owner to acquire ownership of business

- Provides fair market value for deceased owner’s heirs

- Provides liquidity for the family of a deceased owner

Advantages

- Guarantees a purchaser for the business

- Provides liquidity to meet purchasing obligations

- Terms of sale negotiated prior to death

- Heirs of deceased owner receive fair market value

- The family of a deceased owner receives cash to pay estate taxes and/or to meet family needs

- Relieves disinterested heirs of business responsibilities

- Assurance of continued operation for creditors and employees

Disadvantages

- Parties are committed to the agreement even if circumstances change

- Business owner commonly provides cash for third party to purchase life insurance policy

Role of Life Insurance

- Provides liquidity for third party to meet purchase obligation

- Provides immediate full funding of the purchase price

- Less costly funding method than borrowing the funds or using the company’s working capital

- Leverages premium dollars

Tax Considerations

- Death benefit received income tax free

- Purchaser’s cost basis equal to amount paid

- Premiums not income tax deductible

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with the requirements imposed by IRS Circular 230, we inform you that to the extent this communication, including attachments, mentions any federal tax matter, it is not intended or written and cannot be used for the purpose of avoiding Federal Tax penalties. In addition, this communication may not be used by anyone in promoting, marketing, or recommending the transaction or matter addressed herein. Anyone other than the recipient who reads this communication should seek advice based on their particular circumstances from an independent tax advisor. Stifel does not provide legal or tax advice.

0621.3124971.2